Imagine a bustling farmers’ market, overflowing with colorful fruits and vegetables. A local government, concerned about the well-being of farmers, decides to implement a price floor, a minimum price that buyers must pay for their produce. They believe this policy will ensure a fair income for the farmers and prevent them from selling their goods at unfairly low prices. But what happens when the government sets this minimum price at a level higher than the equilibrium price, where supply and demand naturally meet?

Image: droenblog.blogspot.com

The answer lies in the phenomenon known as deadweight loss. This invisible cost, born from market distortions, represents the reduction in total economic surplus, a measure of the overall gains from trade. It’s like a quiet thief, silently stealing away potential benefits from everyone involved – producers, consumers, and the economy as a whole. This article will delve into the concept of deadweight loss associated with price floors, exploring its origins, effects, and implications.

Understanding Price Floors

A price floor is a government intervention in the market, acting as a safety net for producers. It guarantees a minimum price for a product or service, effectively preventing it from falling below a certain level. While it may seem like a straightforward solution to protect producers, price floors can lead to unintended consequences.

Picture a simple scenario: the government sets a price floor for wheat at $10 per bushel, while the market equilibrium price is $8. At the mandated price floor, farmers would ideally be thrilled, eagerly supplying more wheat to the market. But here’s the catch – consumers, however, are less enthusiastic about paying the higher price. The result is a surplus of wheat, as the quantity supplied exceeds the quantity demanded at the controlled price.

The Birth of Deadweight Loss

The surplus resulting from the price floor is the first sign of the deadweight loss. This surplus means some wheat remains unsold, leading to lost opportunities for both producers and consumers. Farmers who would have been willing to sell their wheat at a lower price see their potential income dwindle, as they’re forced to reduce production or dispose of excess goods. Some might even exit the market altogether, unable to compete with the artificially inflated price.

Meanwhile, consumers who would have been willing to purchase wheat at a lower price are denied access to the product. They’re forced to either pay the inflated price, sacrificing their purchasing power, or go without, reducing their overall consumption. This creates a wedge between the willingness of buyers and sellers to trade, effectively reducing the overall efficiency and output of the market.

Visualizing the Deadweight Loss

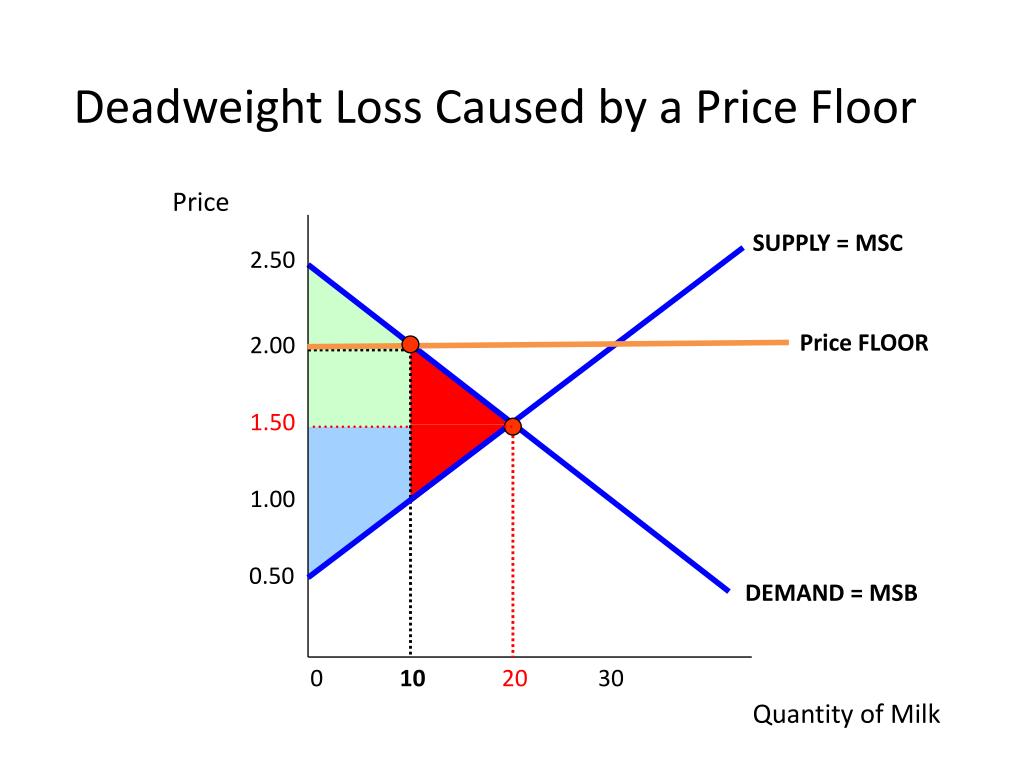

Imagine a simple supply and demand curve diagram. Without a price floor, the market would find its equilibrium price and quantity where the two curves intersect. However, when a price floor is enforced above the equilibrium price, the quantity demanded decreases, creating a gap between the equilibrium quantity and the quantity demanded at the controlled price. This gap represents the surplus of goods that go unsold.

The deadweight loss is visualized as the triangular area between the supply and demand curves, bordered by the equilibrium quantity and the quantity demanded at the controlled price. This triangle represents the lost potential economic benefits, a loss that benefits neither producers nor consumers.

Image: www.slideserve.com

The Consequences of Deadweight Loss

The presence of deadweight loss isn’t just a theoretical curiosity. It has tangible consequences that ripple through the economy. These consequences include:

- Reduced Economic Output: When producers are unable to sell their entire output, they’ll produce less, leading to a decline in overall economic output. This can negatively impact productivity and growth.

- Misallocation of Resources: The surplus of goods suggests misallocation of resources. Resources that could have been used to produce other goods and services are tied up in producing unsold products. This leads to inefficient resource allocation and potentially higher prices for goods and services overall.

- Market Distortions: Price floors distort the natural forces of supply and demand, leading to unintended consequences. Consumers may turn to black markets or find alternative methods to obtain goods, potentially compromising quality and consumer safety.

Minimizing the Impact of Deadweight Loss

While price floors might serve a temporary purpose to protect certain industries or groups, understanding the deadweight loss they create is crucial. Governments should carefully evaluate the benefits and costs of implementing such policies and consider alternative approaches to achieve desired outcomes.

- Targeted Subsidies: Instead of imposing a price floor, governments could consider providing direct subsidies to specific producers in need of support. This allows for targeted assistance without distorting the market.

- Education and Training Programs: Investing in education and training programs for workers in struggling industries can improve their skills and make them more competitive. This can help to boost their productivity and earnings, reducing the need for price floor intervention.

- Demand-Side Measures: Focusing on increasing demand for products and services can help to mitigate the impact of price floors. This might involve promoting consumption through public awareness campaigns or implementing policies that stimulate economic growth.

Real-World Examples

The consequences of deadweight loss associated with price floors can be observed in various sectors around the world. One example is the agricultural sector. In some countries, governments impose price floors on agricultural commodities to protect farmers’ incomes. However, these policies can lead to surpluses, driving down prices for farmers who are not eligible for the price floor. This results in lost opportunities for both producers and consumers.

Another example is the minimum wage, which acts as a price floor for labor. While aimed at improving the lives of workers, it can lead to unintended consequences. Businesses may reduce hiring or cut back on hours to manage the higher labor costs. Additionally, it can displace some low-skilled workers from the workforce, particularly in industries where wages are already close to the minimum wage.

What Is The Deadweight Loss Associated With The Price Floor

Conclusion

Deadweight loss associated with a price floor is not a simple theoretical concept, but a manifestation of flawed market interventions. It represents the lost potential benefits from trade and economic activity, leading to inefficiencies, resource misallocation, and a reduction in overall economic well-being. Understanding the implications of deadweight loss is essential to make informed decisions about government policies and interventions in the market. By considering alternative approaches and minimizing the impact of such policies, we can promote a more efficient and equitable economic system for everyone. This understanding empowers us to navigate the complexities of economic policies and advocate for solutions that maximize efficiency and prosperity for all.