The rhythmic click of a mouse, the flashing green and red of a trading platform, the constant stream of numbers – this was my daily routine. I wasn’t a Wall Street tycoon, but I envisioned a financial future built on careful trading. But a consistent approach was missing. Then, I found it – a trading journal. It wasn’t just about logging trades; it was a journey of self-reflection, strategizing, and learning from every transaction. The impact was profound, and the journey began right here in Princeton, West Virginia. But don’t take my word for it – read on to understand the power of a trading journal.

Image: www.docdroid.net

While many associate trading with high-stakes gambles, it’s actually a strategic arena where discipline and meticulous analysis matter. A trading journal becomes your personal coach, guiding you towards mindful trading and better decisions. This article delves into the world of trading journals, explaining their significance, practical application, and how they can be instrumental in your trading journey, especially if you’re located in Princeton, WV.

Why a Trading Journal Matters

Imagine having a personal record of every trading move you’ve made. Not just the win-loss ratio, but the emotions behind each decision, the market conditions, and your personal thought process. That’s the essence of a trading journal – it’s a powerful tool for tracking, analyzing, and optimizing your trading strategy.

Understanding the Trading Journal’s Function

A Chronicle of Your Trading Journey

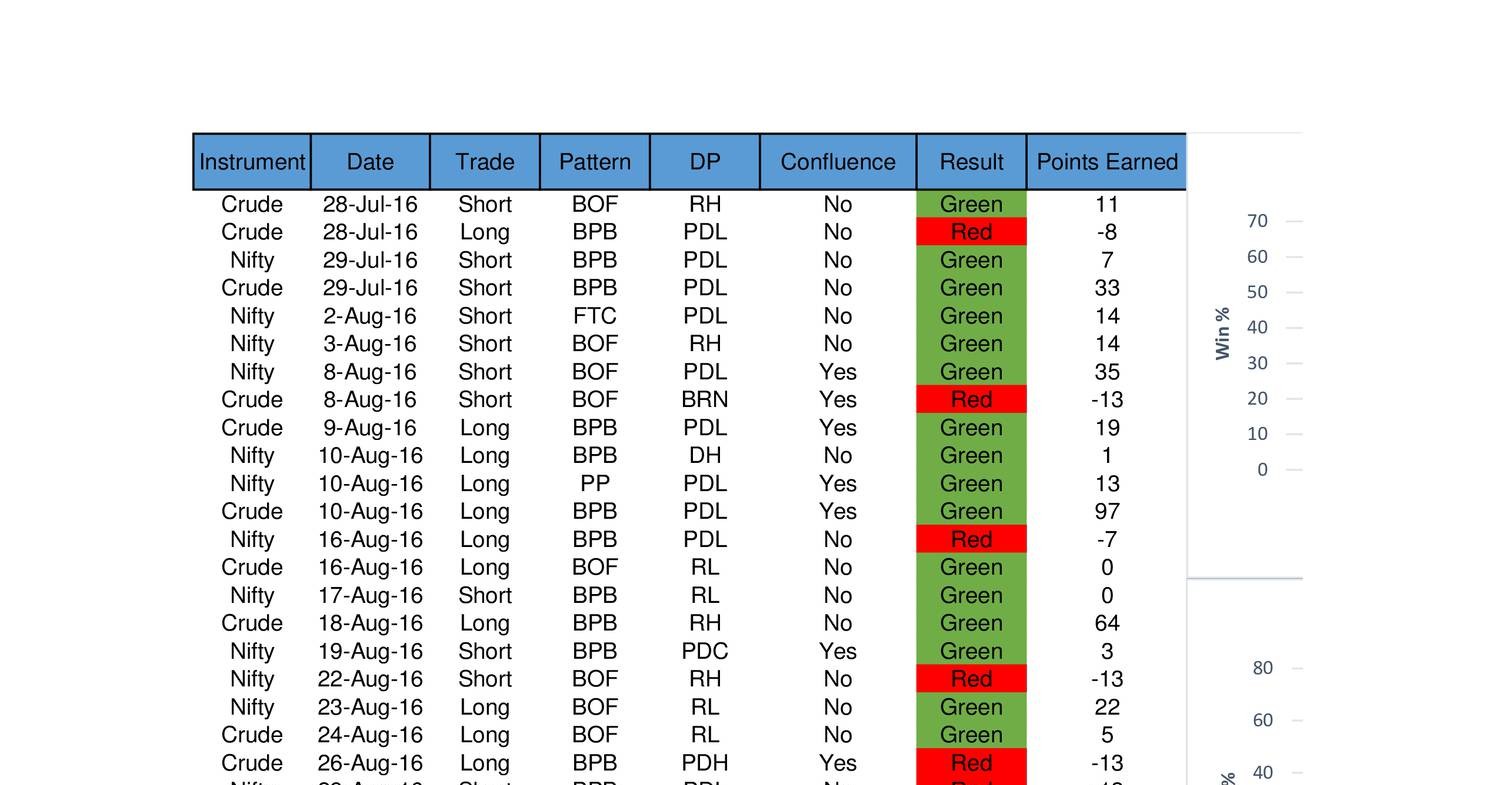

A trading journal isn’t just a log of your “buy” and “sell” orders. It provides a comprehensive picture of every transaction, including details like:

- Date and Time: Track the exact moment you entered and exited a trade.

- Asset: Clearly identify the specific asset traded (e.g., Apple stock, Bitcoin, gold futures).

- Entry and Exit Points: Note the price at which you bought and sold the asset.

- Reason for Entering and Exiting: This is crucial. Why did you choose this asset at this time? What prompted your exit?

- Stop-Loss and Take-Profit Levels: Record your predetermined risk limits and target profit levels.

- Outcome: Was it a profit, a loss, or a break-even?

- Emotions: Capture your emotions at the time of entry, during the hold, and at exit. Did fear or greed influence your decision?

- Market Conditions: Note any relevant market indicators, news events, or trends that influenced your decision.

Image: templates.rjuuc.edu.np

Beyond the Basics

The journal can be customized to your needs, including sections for:

- Market Analysis: Record your technical and fundamental analysis, charts, and research.

- Trading Strategy Notes: Document any adjustments or modifications to your trading plan.

- Learning Points: Reflect on what you learned from each trade, both positive and negative.

- Personal Notes: Document your feelings and perspectives, including any uncertainties or biases.

The Benefits of a Trading Journal

A well-maintained trading journal offers several benefits, including:

- Improved Decision Making: By identifying patterns and analyzing past trades, you can refine your trading strategy and make more informed decisions.

- Enhanced Discipline: The act of logging your trades encourages accountability. You become more conscious of your actions and less likely to impulsively deviate from your plan.

- Emotional Control: Understanding the emotional factors that influence your trading can help you manage fear and greed, leading to more rational decisions.

- Performance Tracking: You can clearly see your progress, identify areas for improvement, and celebrate successes.

- Risk Management: Analyzing your stop-loss and take-profit strategies allows you to adjust your risk tolerance.

The Power of a Trading Journal: Princeton, WV Example

Consider a trader in Princeton, WV, new to the stock market. They might feel overwhelmed by the sheer volume of data and uncertainty. But by using a trading journal, they can track their trades, analyze their performance, and identify patterns in their behavior. This newfound understanding guides them toward a more confident and strategic approach to trading, ultimately enhancing their skills and minimizing risks.

Latest Trends and Developments in Trading Journals

The world of trading journals is evolving with technology. Many traders are embracing digital solutions like:

- Trading Journal Apps: These applications offer pre-built templates, automated data capture, and dynamic visualizations. Examples include Trademetria, TradingView, and Tradovate.

- Spreadsheets: Even classic spreadsheet tools like Excel can be effectively utilized for tracking and analyzing trades.

- Trading Journal Websites: Online platforms built specifically for recording and analyzing trades are gaining popularity.

The emergence of these digital tools streamlines the journaling process, making it more accessible and engaging for modern-day traders, regardless of their location, including those in Princeton WV.

Tips and Expert Advice for Success

To maximize the effectiveness of your trading journal, consider these tips:

- Consistency: Make journaling a habit. Record every trade, regardless of its outcome.

- Honesty: Be truthful about your decision-making process. Record both wins and losses, and be honest about your emotions during the trading process.

- Regular Review: Set aside time each week to review your journal. Identify recurring patterns and areas for improvement.

- Personalized Approach: Adapt the journal format to your preferences and trading style.

- Experiment with Technology: Explore different digital tools to find one that aligns with your needs.

- Don’t Overcomplicate: Focus on the key elements of each trade. You don’t need to document every single detail.

Remember, there’s no one-size-fits-all approach to trading. Your trading journal is your personal guide; embrace it, adapt it, and use it to enhance your journey toward greater trading success.

FAQ

Q: Is a trading journal mandatory for success?

A: While not mandatory, it is highly recommended. A journal is a valuable tool that can significantly enhance your trading strategy and performance.

Q: How frequently should I update my journal?

A: Ideally, update your journal immediately after each trade. This ensures accuracy and preserves the freshness of your thoughts.

Q: Can I use a simple notebook for my journal?

A: Absolutely! A physical notebook can be just as effective as a digital tool. Choose what works best for your personal style and workflow.

Q: What is the best time to review my trading journal?

A: Set aside a regular time, such as the end of the day or the weekend, for a comprehensive review. This allows for proper reflection and analysis of your trades.

Q: How can I maintain motivation to keep up with journaling?

A: Link journaling to your overall trading goals. Think of it as an investment in your future success. The more diligent you are, the more valuable your journal becomes.

Trading Journal Princeton Wv

Conclusion

From the bustling financial markets to the quiet streets of Princeton, WV, the concept of a trading journal remains a powerful tool for any trader seeking to optimize their strategy and enhance their performance. Embrace journaling as a key aspect of your trading journey, and let it guide you towards greater financial success.

Are you a trader based in Princeton, WV? Do you currently use a trading journal? Share your experiences and insights in the comments below. Let’s build a community of informed and successful traders together!