Have you ever found yourself staring at a labyrinthine spreadsheet filled with numbers, bewildered by the complexities of business transactions? I’ve been there! As a budding entrepreneur, I struggled to understand the intricacies of journalizing and posting these transactions. It felt like navigating a dense jungle without a map. But, fear not, dear readers! Today, we’ll unravel the mystery together and demystify the process of accurately recording and reflecting business happenings in your financial records.

Image: www.chegg.com

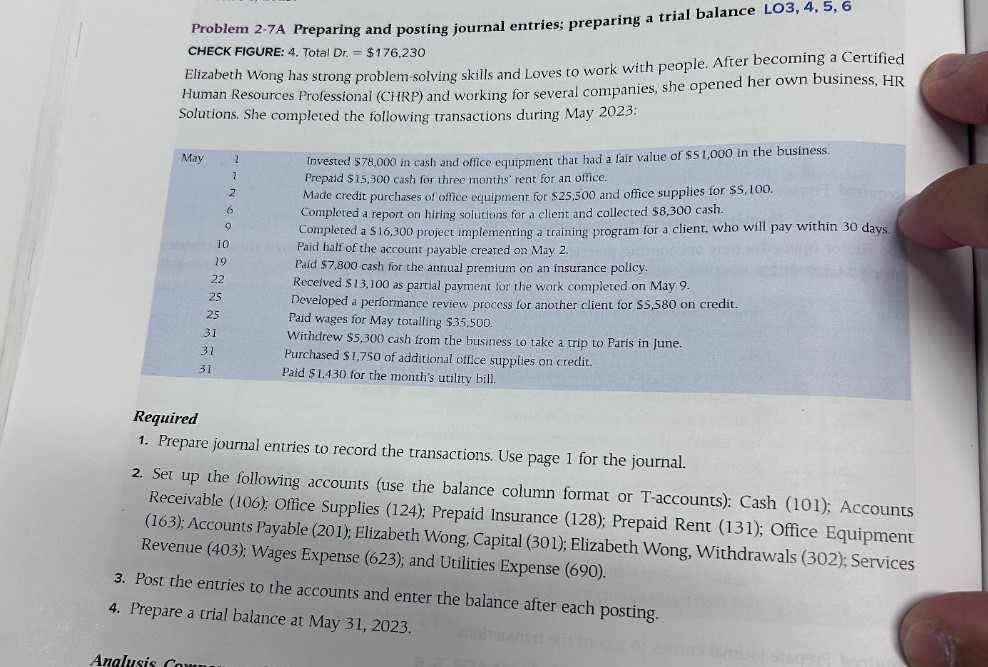

This article will equip you with a clear understanding of problem 7-8 journalizing and posting business transactions, empowering you to confidently track your business’s financial health. We’ll dive into the core concepts, explore essential tips, and even address common questions to ensure you have a solid grasp of this vital aspect of accounting.

Understanding the Basics of Journalizing and Posting Business Transactions

At the heart of every sound accounting system lies the process of journalizing and posting business transactions. Imagine it as the meticulous chronicle of your business’s financial journey, recording every transaction in a precise and structured manner. Journalizing is the initial step, where each transaction is entered into the journal, a chronological record of events. This journal entry captures the essence of the transaction, outlining the accounts involved, the monetary value, and the date of occurrence.

Think of it like a diary for your business, where you meticulously record every financial interaction. Each entry in the journal follows a specific format with debits on the left side and credits on the right side. The double-entry bookkeeping system ensures that every transaction is reflected in two accounts, maintaining a perfectly balanced equation.

Decoding the Process: A Step-by-Step Guide

Step 1: Identify the Accounts Affected

The first step in journalizing a transaction is to determine the accounts it impacts. This could involve assets, liabilities, equity, revenue, or expenses. Let’s say your business sells a product for $100. This transaction involves two accounts: Cash (asset) and Sales Revenue (revenue).

Image: adalynn-chapter.blogspot.com

Step 2: Determine the Increase or Decrease in Each Account

Once you’ve identified the accounts, consider how the transaction affects their value. In our example, the cash account increases because you received $100, while the sales revenue account also increases as you’ve generated income. Remember, every transaction has a dual effect.

Step 3: Apply the Rules of Debit and Credit

This is where the magic of double-entry bookkeeping unfolds. Each account has a normal balance (debit or credit) that determines whether an increase in its value is reflected as a debit or a credit.

Here’s a handy table to guide you:

| Account Type | Normal Balance | Increase | Decrease |

|---|---|---|---|

| Assets | Debit | Debit | Credit |

| Liabilities | Credit | Credit | Debit |

| Equity | Credit | Credit | Debit |

| Revenue | Credit | Credit | Debit |

| Expenses | Debit | Debit | Credit |

In our sale example, since cash (asset) has a debit normal balance and increased, we would record a debit of $100. Conversely, sales revenue (revenue) has a credit normal balance and increased, leading to a credit of $100.

Step 4: Journalize the Transaction

Now, you’re ready to record the transaction in the journal. The journal entry will look like this:

| Date | Account Title | Debit | Credit |

|---|---|---|---|

| [Date of Sale] | Cash | $100 | |

| Sales Revenue | $100 |

Step 5: Post to the General Ledger

After journalizing, the transaction needs to be posted to the general ledger, where each account has its own dedicated column. The general ledger provides a summary of all transactions affecting each account. This posting process ensures that all financial information is systematically organized and readily accessible.

Tips for Success: Mastering Journalizing and Posting

Here are some tips to help you navigate the world of journalizing and posting with greater confidence:

- Use a well-organized accounting system: A clear and efficient system is key to accuracy and ease of use. Consider using accounting software or spreadsheets designed to simplify transaction recording.

- Maintain a consistent journal format: Employing a consistent format helps with clarity and reduces the risk of errors. Stick to a standard format for recording transactions.

- Double-check your entries: Always verify your entries before posting to ensure accuracy. Review each transaction for completeness and correctness.

- Seek guidance when needed: Don’t hesitate to consult with a financial advisor, accountant, or accounting resource for assistance with complex transactions. There’s no shame in asking for help to navigate intricate situations.

These tips will ensure that your financial records are reliable and trustworthy, providing a solid foundation for making informed business decisions.

Common Questions: Debunking Financial Mysteries

Q: What is the difference between debit and credit?

In the world of accounting, debit and credit are not simply terms for adding and subtracting. They represent the opposite sides of a transaction, indicating an increase or decrease in specific accounts. Assets, expenses, and dividends have a normal debit balance, while liabilities, equity, revenue, and gains normally have a credit balance. The specific action of debiting or crediting an account depends on its type and whether it’s increasing or decreasing.

Q: Why is double-entry bookkeeping important?

The beauty of double-entry bookkeeping lies in its inherent balance. Every transaction has a two-fold impact, ensuring that the accounting equation (Assets = Liabilities + Equity) remains in equilibrium. This meticulous approach helps identify and correct errors, ensuring the accuracy and reliability of your financial records.

Q: How can a poorly maintained accounting system affect my business?

A poorly maintained accounting system can lead to inaccurate financial statements, hindering informed decision-making and potentially jeopardizing the future of your business. It can also lead to missed opportunities, wasted resources, and even legal repercussions for inaccurate tax reporting.

Problem 7-8 Journalizing And Posting Business Transactions

Conclusion: Empowering You with Financial Clarity

Mastering the art of journalizing and posting business transactions empowers you to navigate the intricacies of accounting and achieve financial clarity. This knowledge is crucial for building a sustainable business and making informed decisions about your financial health.

Are you ready to take control of your business’s financial records and confidently navigate the world of journalizing and posting? If so, dive into the resources available to you, practice your skills, and never be afraid to seek advice when you need it. Your business’s financial well-being depends on it!