Remember that first time you saw a balance sheet, a jumble of numbers and cryptic labels? It felt like unraveling a secret code, right? Well, accounting can feel like that sometimes, but understanding the basics is essential, especially when it comes to journalizing transactions. This is the bedrock of accounting, the very process that transforms raw financial information into a structured narrative. In this post, we’ll explore the world of journalizing, understanding the fundamentals, and even getting a sneak peek at some common answer keys for Chapter 3 exercises.

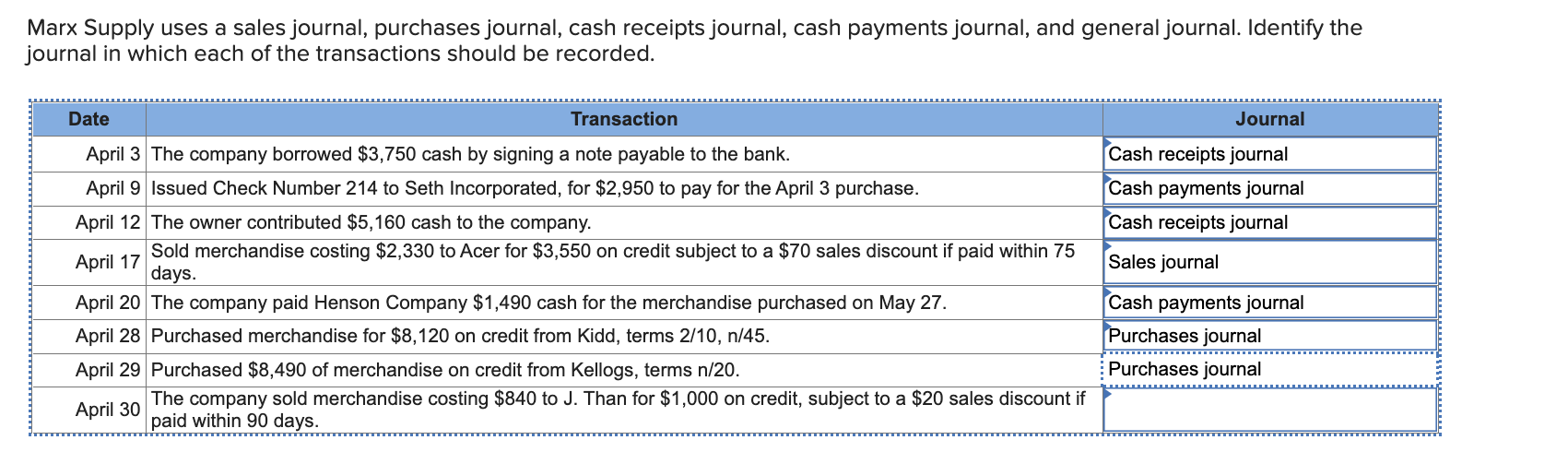

Image: www.chegg.com

It’s like learning a new language. The foundation is critical. Every debit and credit, every journal entry, all build upon this fundamental skill. Think of it as the alphabet of the business world. Once you understand the logic behind journalizing, you can analyze financial data, interpret financial statements, and make informed business decisions. So buckle up! We’re diving into the fascinating world of journalizing transactions, where numbers tell stories and balance sheets become your trusted guides.

Unveiling the Mystery of Journalizing Transactions

Journalizing transactions is the first step in the accounting cycle, the process of recording all financial transactions in a chronological order. Imagine it as a detailed diary of a company’s financial activities, providing a complete record of every transaction from inception to completion. This process is essential for understanding a company’s financial health, analyzing its performance, and making informed financial decisions.

The Building Blocks of Journalizing

The heart of journalizing lies in understanding debits and credits. These are the two sides of every accounting equation, representing an increase or decrease in assets, liabilities, and equity. Think of it like a seesaw: every entry on one side must have a corresponding entry on the other, keeping the equation balanced. Each transaction is recorded in a journal, which is like a ledger that acts as the initial recording system for financial transactions.

The basic formula for journalizing is simple:

Debit = Credit

To determine the debit and credit sides of a transaction, we follow the rules of the accounting equation:

- Assets: An increase in assets is recorded as a debit, and a decrease is recorded as a credit.

- Liabilities: An increase in liabilities is recorded as a credit, and a decrease is recorded as a debit.

- Equity: An increase in equity is recorded as a credit, and a decrease is recorded as a debit.

For example, if a company purchases inventory on credit, the following journal entry would be made:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 2023-10-27 | Inventory | $10,000 | |

| Accounts Payable | $10,000 |

In this example, the inventory (an asset) increases, so it is debited, while accounts payable (a liability) also increases, so it is credited. By understanding these basic rules, you can translate complex business transactions into clear accounting language.

The Importance of Journalizing

Journalizing isn’t just a procedural step; it serves as the cornerstone of accurately tracking a company’s financial activity. The information captured in the journal is the raw data for creating financial statements, offering invaluable insights into the company’s financial position and performance. Here’s how journalizing ensures financial accuracy:

- Complete and Accurate Record-keeping: Each journal entry acts as a verifiable record, ensuring that transactions are documented comprehensively and accurately. This helps prevent errors and ensures financial transparency.

- Foundation for Financial Statements: Information recorded in the journal becomes the building blocks for creating vital financial statements like the balance sheet, income statement, and statement of cash flows. These statements provide a comprehensive picture of the company’s financial health and performance.

- Auditing and Compliance: Journalizing ensures that businesses have a readily available record of their financial transactions, making it easier to comply with accounting standards and regulations. This is essential for external audits and ensuring that financial statements are accurate and reliable.

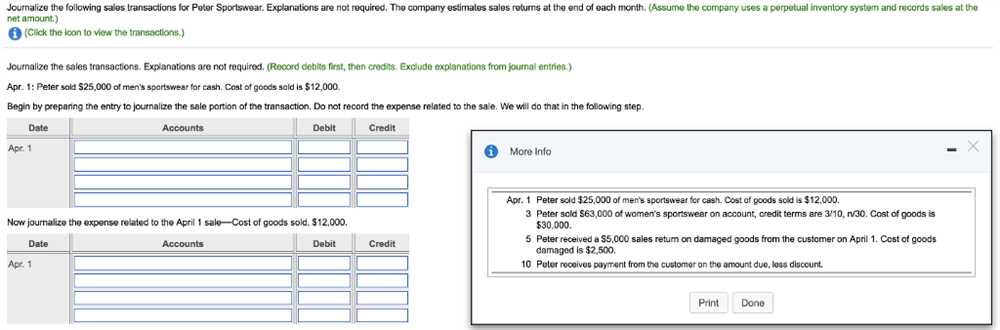

Image: studyfinder.org

Navigating the Journalizing Process

Let’s break down the steps involved in journalizing a transaction:

- Identify the accounts affected: Determine the accounts that are impacted by the transaction. This could involve assets, liabilities, equity, revenues, or expenses.

- Apply the debit-credit rules: Based on the accounting equation, decide whether to debit or credit the affected accounts.

- Record the transaction: Enter the transaction details in the journal, including the date, accounts, debit amount, and credit amount. Ensure the total debit amount equals the total credit amount.

It’s important to remember that journalizing transactions is both an art and a science. Mastering the technique requires a clear understanding of the accounting equation, a methodical approach, and attention to detail.

Chapter 3: Journalizing Transactions Answer Key

Now, let’s address the elephant in the room: the Chapter 3 answer key. While finding the answers is tempting, it’s crucial to remember that understanding the “why” behind those answers is much more valuable. You can find answer keys online or in practice materials, but remember they are meant to be supplements to your learning journey.

If you want to master journalizing, focus on applying the rules and principles, not just memorizing the answers. Practice, practice, practice until it becomes second nature. Use the answers to validate your knowledge, analyze your approach, and identify areas where you need more clarity.

Tips for Success

Here are some tips for navigating the world of journalizing transactions effectively:

- Start simple: Practice with straightforward transactions, gradually increasing complexity as you gain confidence.

- Use templates: Many accounting software programs and online resources provide templates for journalizing, making the process smoother.

- Don’t be afraid to ask for help: If you get stuck, reach out to your instructor, classmates, or accounting experts. They can provide valuable guidance and support.

Expert Advice

One way to truly master journalizing is to simulate real-world scenarios. You can create practice transactions based on fictional businesses or use case studies from your textbook. This helps you see how the accounting principles apply in different contexts, strengthening your understanding.

Another important piece of advice is to make journalizing a regular part of your routine. Whether you’re studying accounting or working in a finance-related field, practicing journalizing regularly helps keep the concepts fresh and builds confidence in your skills.

FAQs: Journalizing Transactions

Here are some frequently asked questions about journalizing transactions:

Q: What is the difference between a journal and a ledger?

A journal is where we record transactions in chronological order. The ledger uses the journal entries to organize this information by account, creating a detailed summary of each account’s activity.

Q: Why is it important to keep the accounting equation balanced?

Balancing the equation ensures that every financial transaction is recorded accurately. It ensures that the assets of a business equal the sum of its liabilities and equity, reflecting the fundamental relationship between a company’s resources and obligations.

Q: How do I know which account to debit and which account to credit?

Use the accounting equation as your guide. Remember that assets are increased by debits and decreased by credits. Liabilities are increased by credits and decreased by debits. Equity is increased by credits and decreased by debits. Apply these rules to each transaction.

Chapter 3 Journalizing Transactions Answer Key

Conclusion: Mastering the Art of Journalizing

Journalizing transactions is a fundamental skill in accounting, the foundation upon which all other financial analysis and decision-making rests. By understanding the basic principles and following the rules of debit and credit, you can effectively record financial transactions and acquire invaluable insight into a company’s financial position.

Remember, practice is key! Whether you’re a student tackling Chapter 3 or a professional in the finance world, consistent practice and a thorough understanding of the concepts are essential for mastering the art of journalizing transactions. Now that you’ve learned more about journalizing, are you interested in learning more about this topic?